|

SERVICE

Fee/Payment Cycle example |

|---|

| Card Reader method | Mobile Phone method | WEB method | |

|---|---|---|---|

| Initial cost | 3000 JPY | 3000 JPY | Depends on sales scale and type of industry |

| Monthly cost | 1000 JPY | 1000 JPY | Depends on sales scale and type of industry |

| Sales charge fee | 54 JPY/once | 54 JPY/once | 54 JPY/once |

| Settlement fee | 2.5%~Depends on sales scale and type of industry |

||

| Card reader price | Free | - | - |

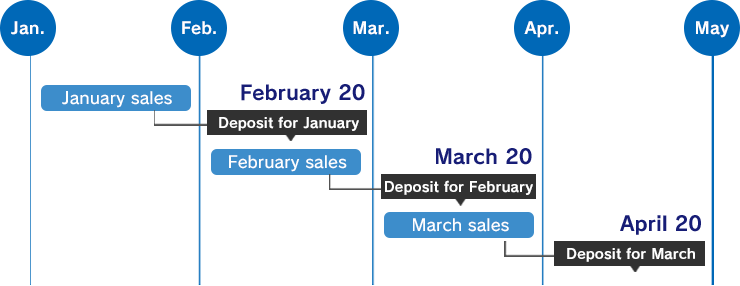

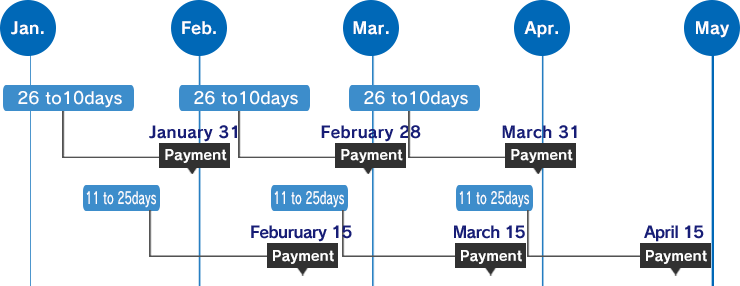

The basic payment cycle is twice a month, closing on the 15th / payment on the 5th day of the next month and closing at the end of the month / payment on the 20th day of the next month.

Additionally, for once a month, closing is at the end of the month / payment on the 20th day of the next month.

Of course, depending on the type of industry, there are also existing merchants who requested to pay in another cycle though it is once a month, so we will respond to each type of business.

The payment cycles of many card companies are mainly on a monthly cycle, but our company will respond to the requests from Merchants and will provide a twice a month cycle.

* Depending on the results of the examination, we may not be able to comply with your request.

Despite how common this inquiry is, many companies, even domestic card companies, tend to not specifically display their payment service on their WEB sites.

As a way to introduce Merchants to our company, we have settlement fee and payment cycle examples on our website.

Although, the card payment system and service we provide is accross the board, the price may vary across Merchants. Instead of listing the price for each industry, instead we will try to explain the mechanism as to why in an easy-to-understand manner.

Card companies have established their own judging standards. With this in place we can not provide our service everywhere, for instance, affiliated stores that are registered at some addresses in Ueno, Taito-ku, and Tokyo. Not only specific addresses but in some very rare situations, entire streets can be affected.

This is the result of complicated regulations (rules within the industry) owned by card companies, results of past experiences, and insurance premiums. For these reasons, the settlement fee may be much higher than expected.

We are pleased to inform you that the lowest settlement price is from 2.5% ~. It should be noted that, the price is not uniform across all Merchants.

At our company, we are providing a service that can be used domestically and abroad, across various industries.

Based on our many years of experience, we have adopted a system to calculate points based on cumulative data such as merchandise to be handled, service type, cancellation incidence rate, CB rate etc. MAXCONNECT informs Merchants of the exact fee amount, not a generalization that many settlement companies give.

Since our office also controls the Sales department, the commission fee will not be different depending on the person in charge or who you are speaking to.

So, if you are currently using another settlement company and wish to switch to MAXCONNECT's settlement service, we would like to first give a re-estimate. There are often cases where Merchants receive a quotation at our company, and find it to be cheaper than their current service.