About Payment Collection Agency Service

Payment Collection Agency Service is a money transfer service that allows users to make payments in real-time using online banking, similar to payments by card.

Payment result is automatically reflected in the merchant’s management portal, 24/7/365.

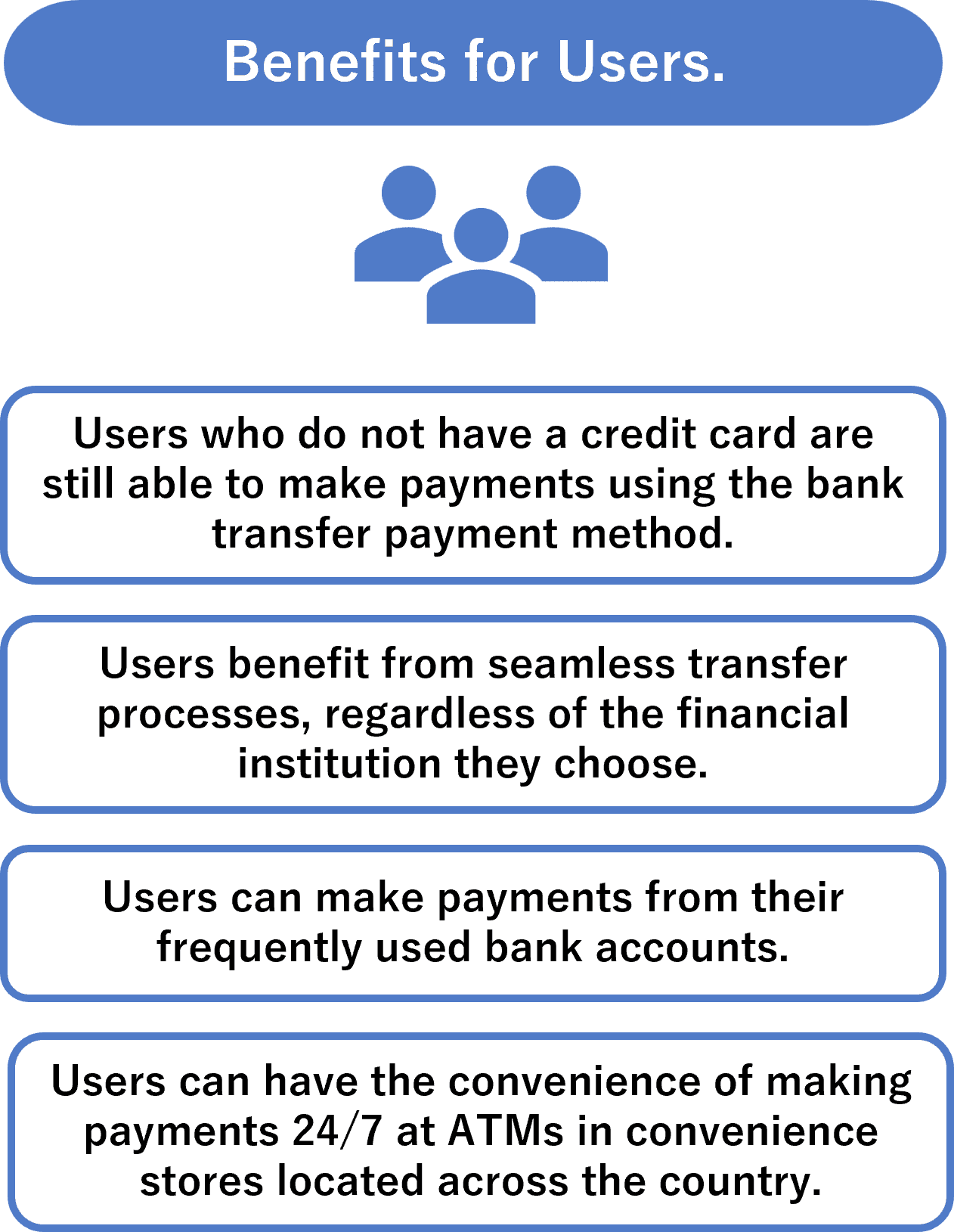

Users who do not have a credit card are still able to make payments using the bank transfer payment method.

Advantage 1

Send money to any financial institution across Japan.

Payment Collection Agency Service allows users to send money from a variety of locations across the country, including major financial institutions, post office counters, ATMs and through online banking.

Advantage 2

Real-Time Payments (RTPs)

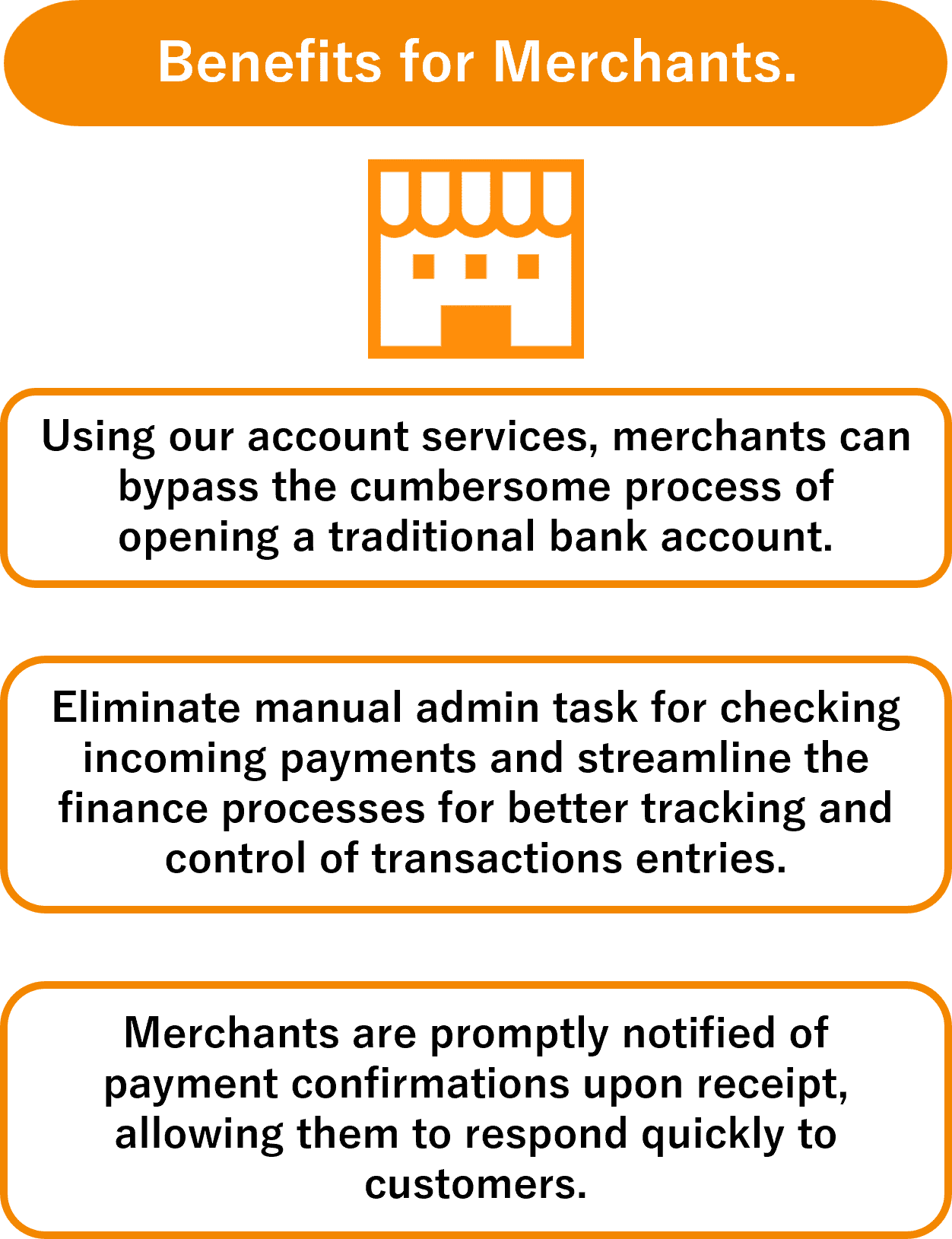

Get full peace of mind with automated alerts every time customers make payments through major financial institutions or post office counters. Our system continuously monitors receipt payment information in real-time, providing merchants with instant notifications.

Advantage 3

Easy set up

This service enables companies and sole proprietors from overseas to easily utilize it without the need to forming a Japanese corporation or opening a bank account with Japanese financial institutions. Furthermore, the need for a complex integration system with each financial institutions is eliminated. Our streamlined process ensures a hassle-free experience for all users.

Advantage 4

Dedicated account for settlements

Maxconnect provides a dedicated account for settlements, distint from the merchant’s primary account, which includes various expenses such as overhead and other charges, streamlines management processes.

Advantage 5

Automate processes of bank transfer to streamline operations and increase efficiency

Maxconnect handles all matters relating to merchant’s bank transfer operations, eliminating any hassle so merchants can focus and concentrate on growing their business.

Advantage 6

Expediting service provision

Merchants receive automatic notifications upon receipt of transfer payments, enabling them to promptly provide services to customers.

Advantage 7

Flexible and seamless payment experience

Customers can make payments anytime, anywhere from smartphones, computers or through ATMs with the convenience of our system.

Advantage 8

Get your sales organized

Efficiently track and manage merchant’s daily sales, payment statuses, and order cancellation statuses all in one place with our merchant management portal.

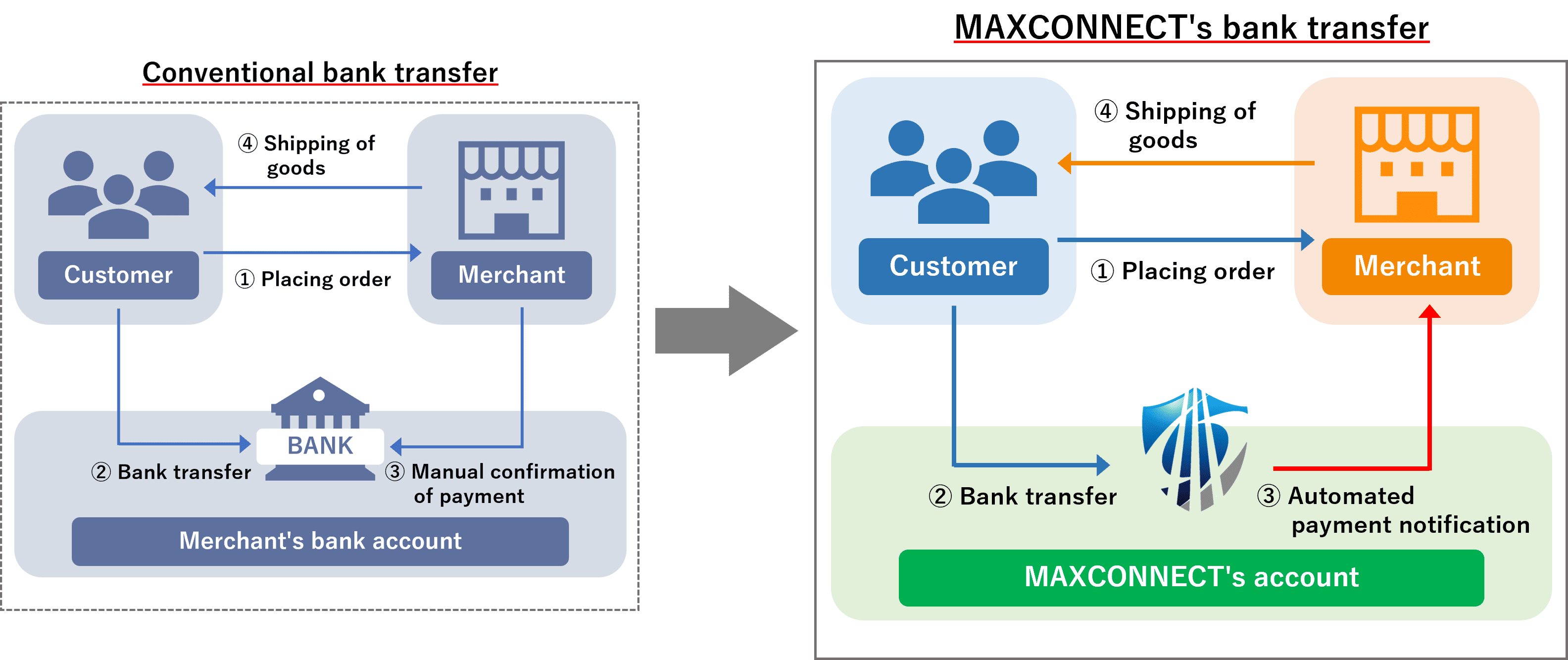

How it works

It may be difficult to understand what Payment Collection Agency Service is. Therefore, we would like to explain exactly how our Payment Collection Agency Service is used.

(1) We issue bank account to merchant according to the number of end user.

(2) Merchant will assign the provided bank account to each end user.

(3) End user deposits the purchase amount into the issued bank account.

(4) When the funds arrive in the bank account, we will notify to merchant of which end user has paid and how much.

(5) Once the merchant receives the notification, they will begin preparing the products for shipment and deliver it to the end user.

As shown above, the process from invoicing to confirmation of payment is carried out automatically.

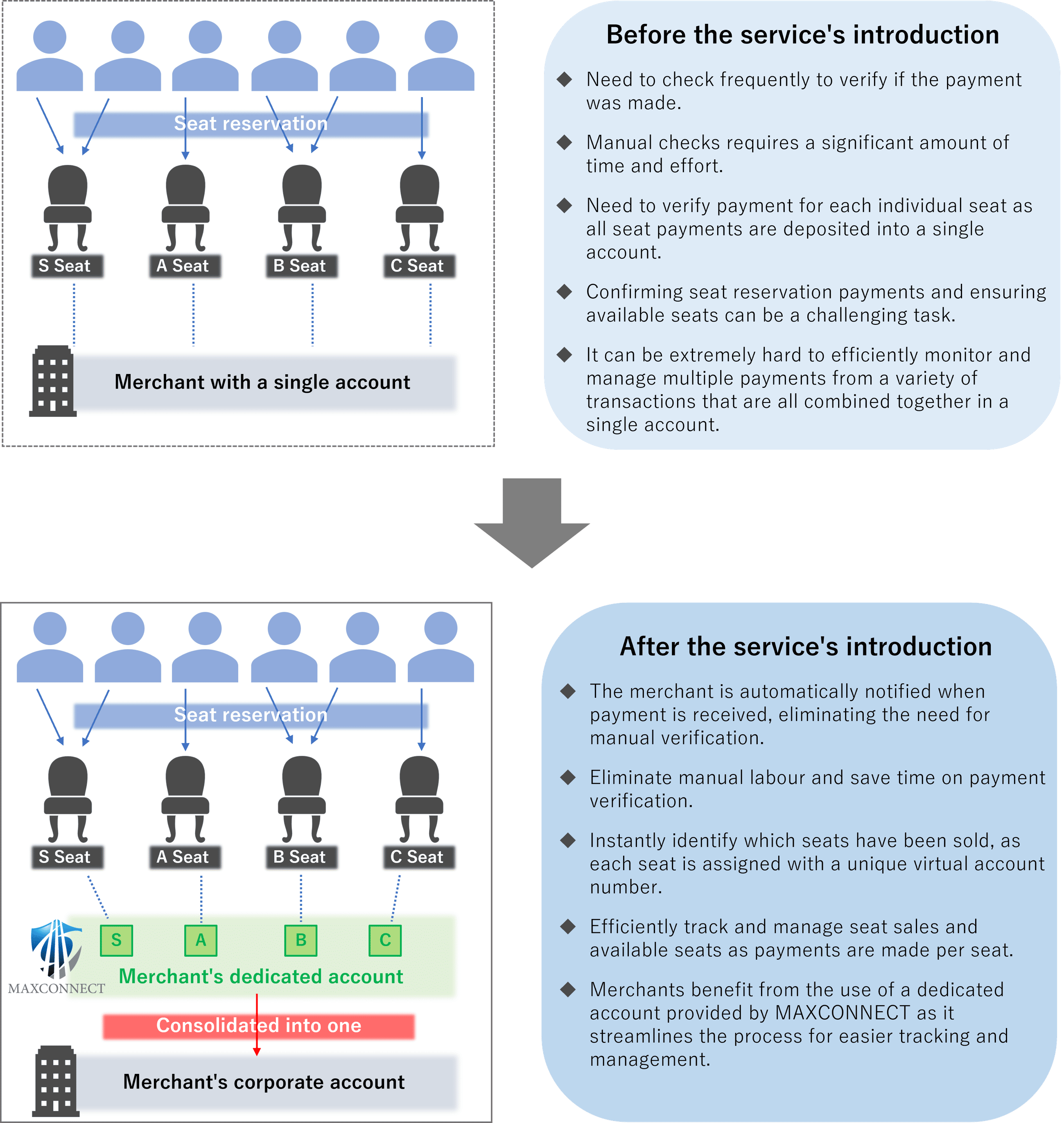

Case Study & Success Story ‐Event Management Company A

As an illustration, consider an event management company that offers four different types of seats (S, A, B, and C) for sale through conventional bank transfer. If the merchant only has one account, as depicted in the diagram on the left, the fees for each seat are all deposited into that single account at once. This can create challenges in reconciling seat reservation payments with available seats, as payments from other transactions are mixed together.

By using MAXCONNECT’s Payment Collection Agency Service, each seat is assigned to a unique virtual account number. This feature significantly streamlines the management process for event management companies.